Guiding Investments for Today and Tomorrow: Lean Budgeting Horizons 0–3 Explained

Jul 20, 2025

In fast-changing markets, traditional project-based funding is too rigid to respond to evolving customer demands and emerging opportunities. The Scaled Agile Framework (SAFe) addresses this challenge with Lean Portfolio Management (LPM) and its practice of Lean Budgeting, which funds value streams instead of isolated projects.

This dynamic funding model empowers portfolios to pivot based on real-time insights while maintaining alignment to strategic objectives and customer value.

The Four Investment Horizons

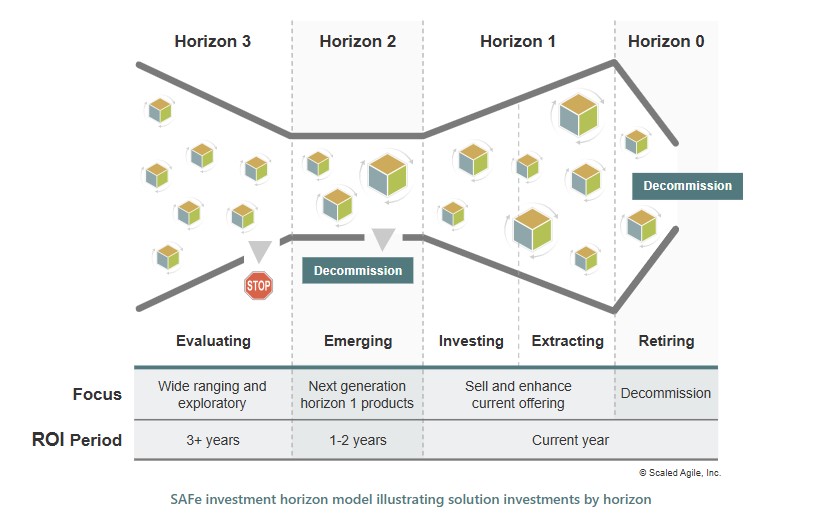

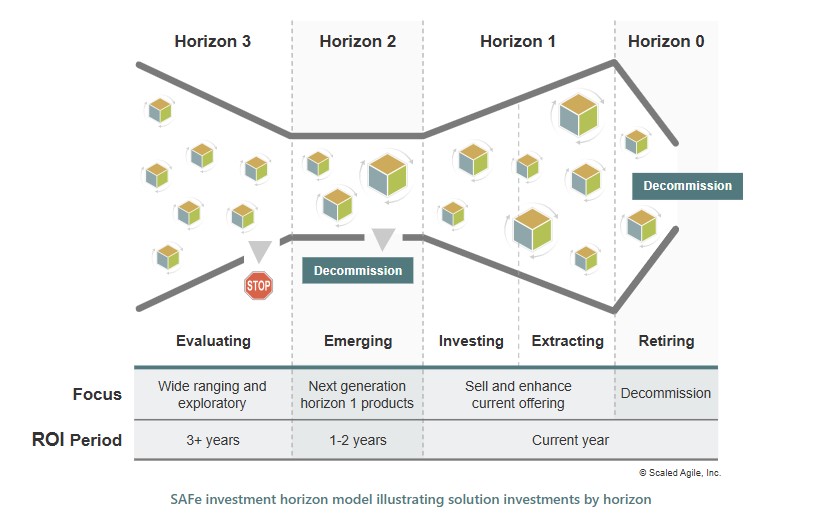

SAFe’s investment horizon model helps portfolio leaders distribute funds across four timeframes, ensuring a healthy balance between current delivery, upcoming growth opportunities, and eventual decommissioning of obsolete solutions.

Horizon 0: Retiring or Decommissioning Solutions

Horizon 0 represents the end-of-life phase of products or solutions. Investments here focus on safely retiring legacy systems, migrating customers, reducing technical debt, and freeing resources for new opportunities. Funding Horizon 0 work prevents costly maintenance of outdated systems and accelerates the organization’s ability to pivot toward strategic initiatives.

-

Decommissioning outdated platforms or technologies

-

Migrating data and users to newer solutions

-

Closing out contractual obligations and compliance requirements

Horizon 1: Current Solutions

Horizon 1 funds today’s core offerings—the products and services actively delivering value to customers and generating revenue. These investments maintain competitiveness, support ongoing operations, and provide incremental enhancements.

Horizon 2: Emerging Opportunities

Horizon 2 focuses on scaling initiatives that have demonstrated promise but are not yet mature. This horizon bridges the gap between maintaining current revenue streams and preparing for near-future growth.

Horizon 3: Future Bets

Horizon 3 targets long-term, disruptive innovation—initiatives that may redefine the organization’s future. These high-risk, high-reward investments explore technologies, markets, or business models that could become tomorrow’s competitive advantage.

Balancing Investments Across Horizons

A well-balanced portfolio avoids over-investing in current solutions (Horizon 1) while neglecting future opportunities (Horizons 2 and 3). It also deliberately funds Horizon 0 activities to retire legacy solutions, ensuring resources are not trapped maintaining obsolete systems.

Guardrails help determine budget mix—for example:

-

Horizon 0: 5–10%

-

Horizon 1: 50–60%

-

Horizon 2: 20–25%

-

Horizon 3: 10–15%

These allocations adjust dynamically as market signals and strategy evolve.

Applying Lean Budgeting Across All Horizons

1. Fund Value Streams, Not Projects: Build flexibility by allocating budgets to value streams aligned to customer outcomes.

2. Set Horizon Guardrails: Define target percentages for each horizon and revisit them regularly.

3. Continuously Rebalance: Reallocate funds based on PI Planning outcomes, portfolio syncs, and market feedback.

4. Engage Stakeholders: Include business owners and technology leaders in horizon discussions to ensure alignment.

5. Prioritize Outcomes: Evaluate investments by value delivered and alignment with strategic themes, not just delivery progress.

Why Horizon 0 Is Essential

Neglecting Horizon 0 leads to “zombie solutions”—legacy products consuming budget and talent long after their value has peaked. By explicitly funding retirement work, portfolios can:

-

Reduce operating costs

-

Minimize risk from outdated systems

-

Redirect skilled teams to higher-value initiatives

How Bush Agility Can Help

Bush Agility helps organizations implement Lean Portfolio Management practices that align funding with strategy across Horizons 0–3. Our training and consulting guide leaders in managing legacy system retirement, sustaining current offerings, and investing confidently in future innovations.

Ready to balance your portfolio for today and tomorrow?

Contact Bush Agility for Lean Portfolio Management training to learn more about how we can help you maximize value across every horizon.